Investors focus heavily on the UAE and Turkey, overlooking the real opportunities offered by the Caribbean region. Here, real estate investments are paired with attractive citizenship programs.

The United Arab Emirates, Cyprus, Turkey, Greece, Spain, and the United Kingdom have been key destinations for real estate investments in recent years. In the UAE, for example, an investment of $550,000 can secure a 10-year Golden Visa, with rental yields of up to 7.3%. Similarly, Turkey has offered rental yields up to 7%. However, in 2024, demand for real estate in Turkey and the UAE significantly declined—from 42.3% to 7.7%. Factors contributing to this include inflation in Turkey, rising property prices, and an increased threshold for obtaining residence permits.

Against this backdrop, investors are increasingly turning to new promising destinations such as Greece, Portugal, and Caribbean countries, which have become leaders in popularity in 2023-2024.

Caribbean Real Estate Market

Investing in real estate in the Caribbean not only provides income but also opens up opportunities for obtaining second citizenship and optimizing tax liabilities. Five Caribbean countries offer tax incentives, including zero tax rates.

Real Estate in Saint Kitts and Nevis: Investment Property

- Minimum Investment Amount: from $400,000

- Rental Yield: approximately 4-7% per annum

- Holding Period for Resale: minimum 7 years

Real Estate Investments in St. Kitts and Nevis

One of the most luxurious resorts in Saint Kitts, Park Hyatt, offers investors a unique opportunity to invest in property with a mandatory holding period of 7 years and potential rental returns of 0-3% per annum. The minimum investment amount is $400,000. Investors can choose government-approved properties that can be resold after 7 years. The cost per square meter of real estate in Saint Kitts and Nevis ranges from $5,000 to $8,000.

Additional Expenses When Purchasing Property:

- Legal Services: $20,000

- Due Diligence: $10,000

- Registration Fees: $10,000

- Passport Fee: $500

Real Estate in Antigua and Barbuda

- Minimum Investment Amount: from $300,000

- Rental Yield: approximately 2-5% per annum

- Holding Period for Resale: minimum 5 years

Real Estate Investments in Antigua and Barbuda

An investment in a share of the Moon Gate hotel for $300,000 can generate rental income of $12,500 annually. The Antigua and Barbuda Citizenship Program offers investors a wide range of real estate options, including shared ownership in resort complexes like Moon Gate or full ownership of luxury villas and apartments. For example, new apartments of 60-80 m² in a resort complex with a common garden and pool, located 100-500 meters from the sea, cost from $400,000 to $600,000. Villas with 2-3 bedrooms, located 100-200 meters from the shore, will cost from $600,000 to $900,000.

Property Options:

- Moon Gate Antigua: This exclusive hotel and spa complex with 49 rooms is located on one of Antigua’s most beautiful beaches—Half Moon Bay. The price for Premium Suites with Plunge Pool is $400,000, and for One Bedroom Penthouse Suites—$650,000. The mandatory holding period is 5 years, with a rental yield of 5%.

- South Point: A fully approved CIP project, including 23 condominiums and a restaurant. The project is already completed and operates as a condo-hotel, with rental program participation available. Shares are available from $200,000, and condominium prices have been reduced to $495,000. The expected rental yield is approximately 2% per annum.

- The Gardens: This complex includes 36 plots with villas of 2, 3, and 4 bedrooms. For investors aiming to obtain citizenship, shared ownership is offered at a price of $200,000 for 1/6th of a villa. The full villa price ranges from $1.2M to $1.6M. Guaranteed yield for shared ownership is 2% per annum.

- Antigua Verandah Estates: Fully furnished villas on plots of 10,000 square feet, with appliances, a pool, and landscaping. A 2-bedroom villa costs $400,000, and a 3-bedroom villa—$450,000. Rental management is available, though income is not guaranteed.

- Sugar Ridge: Luxury condominiums and villas on a 43-acre site. Condos with stunning views are available from $850,000, while villas start at $2.6 million. Investment in this project can generate rental income, which is possible through management services with a 20% management fee.

- The Beach Houses: A private beachfront community of 10 custom-built homes. Prices range from $1.5M to $4.4M (land and villa). The holding period is 5 years, and rental income is not provided.

- Villa Seabreeze: A luxury 8,000 square foot villa in the gated community of Nonsuch Bay. The project is under construction, with completion expected within 24 months. The price is $4.5M, and rental income is not provided.

Additional Expenses When Purchasing Property:

- Legal Services: $20,000

- Due Diligence: $8,500

- Government Fees: $10,000

- Passport Fee: $300

Real Estate in Grenada

- Minimum Investment Amount: from $270,000

- Rental Yield: approximately 4% per annum

- Holding Period for Resale: minimum 5 years

Real Estate Investments in Grenada

Purchasing an apartment for $350,000 can generate rental income of up to $17,500 annually. Grenada’s Citizenship Program offers investors a wide range of properties, including unique resort complexes and residential projects that can provide both comfortable living and rental income.

Property Options:

- InterContinental Grenada Resort: This luxury resort includes over 30 private suites, various restaurants and bars, a spa, a pool with a bar and grill, a fitness center, and about 6,000 square feet of conference halls and a business center. The minimum investment amount is $220,000. The holding period is 5 years. The expected rental yield is 0-3% per annum.

- Grenada National Resort: Designed as a world-class resort, this project covers nearly 412 acres on the northern part of the island in Levera. The resort includes luxury hotels, a casino, an 18-hole golf course, an amusement park, and a marina. The minimum investment amount is $220,000. The holding period is 5 years. Rental yield is not guaranteed.

- The View (The Legacy Project Inc.): This project includes a hotel and villas located on a two-acre site with stunning views of Grand Anse and the Caribbean Sea. The project will be implemented in two phases: the first phase is the creation of a luxury boutique hotel with 40 rooms, and the second phase is the construction of modern villas. Investors are entitled to a share of the rental income proportional to their share in the project. The minimum investment amount is $220,000. The holding period is 5 years.

- The Hartman Resort and Hartman University Town: A project combining a university campus, a five-star resort, and residential areas. Designed for the integration of education, wellness, and luxury, this project offers accommodation for students and faculty, as well as shopping and entertainment areas. The minimum investment amount is $220,000 for a share and from $350,000 for student apartments. The guaranteed rental yield is 3-3.5% per annum for 5 years.

- The Beach House Resort: A small luxury boutique hotel on Portici Beach, consisting of 30 rooms with unique architectural features. The hotel offers an exceptional guest experience with the choice of rooms by the beach or on the cliff. All villas in the project have been sold, and the launch of the third phase for the sale of new properties is expected. The minimum investment amount is $220,000. The holding period is 5 years.

Additional Expenses When Purchasing Property:

- Legal Services: $20,000

- Due Diligence: $5,000

- Government Fees: $50,000

- Passport Fee: $300

Real Estate in Dominica

- Minimum Investment Amount: $200,000

- Rental Yield: approximately 5% per annum

- Holding Period for Resale: minimum 3 years

Real Estate Investments in Dominica

Dominica offers one of the most affordable citizenship by investment programs in the Caribbean region. The minimum investment amount is $200,000, which allows investors to purchase a share in a resort complex or condominium approved by the government. The citizenship program requires that the property be held for a minimum of 3 years, after which it can be resold while retaining the citizenship. However, many investors prefer to keep the property for 5 years so that the buyer can also qualify for citizenship, increasing the property's liquidity. Dominica is actively developing sustainable tourism projects, which contribute to growing interest in its real estate and increase the value of assets.

Property Options:

- InterContinental Dominica Cabrits Resort & Spa: Opened in October 2019, this resort is located on the tranquil beach of Douglas Bay in Dominica. Considered one of the best in its class, this secluded resort includes 151 rooms and suites, as well as luxury amenities. The minimum investment amount is $200,000. The mandatory holding period is 5 years.

- Dominica Secret Bay: The complex includes 42 villas, each available for purchase through shared or full ownership. Shared ownership starts from $218,000 per share, and full ownership—from $1,500,000 per villa. The holding period for resale is 3 or 5 years, depending on the conditions. Possible rental yield—approximately 3-6% per annum, though not guaranteed.

- Sanctuary Rainforest Eco Resort and Spa: This resort complex is located in a secluded part of the tropical rainforest on the Providence Estate in the Roseau Valley, near the Morne Trois Pitons National Park, a UNESCO World Heritage site. The project covers 10 acres and offers guests unique opportunities to relax in the heart of Dominica’s nature. The minimum investment amount is $200,000. The holding period for resale is 3 or 5 years. The projected yield is 3-6% per annum, though it is also not guaranteed.

Additional Expenses:

- Legal Services: $20,000

- Due Diligence: $7,500

- Government Fees: $75,000

- Passport Fee: $60

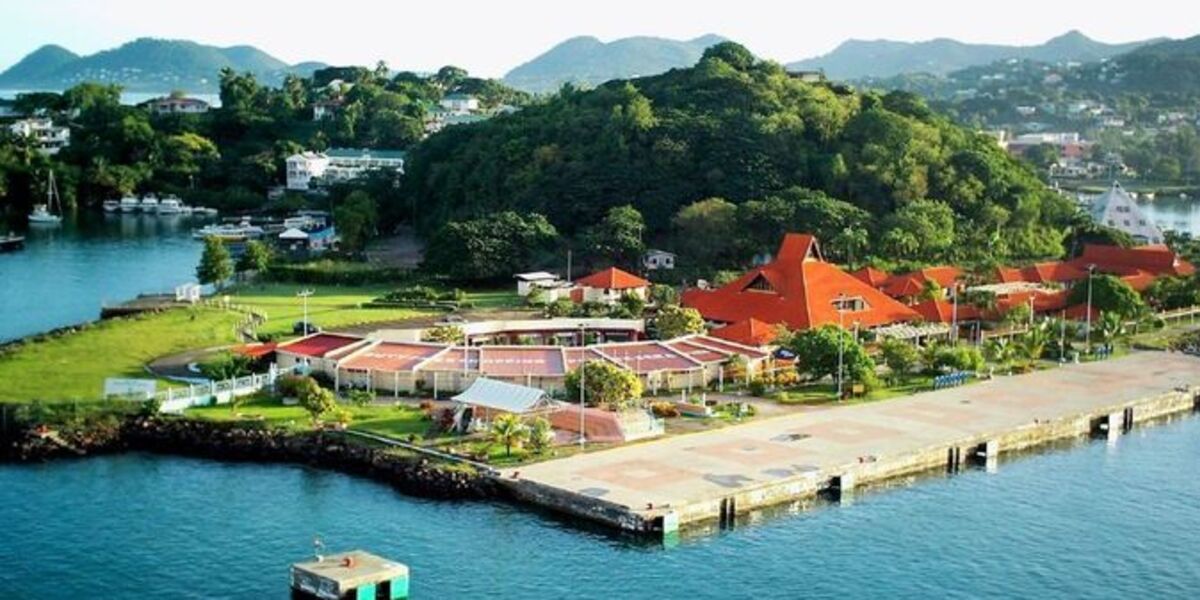

Real Estate in Saint Lucia

- Minimum Investment Amount: $300,000

- Rental Yield: approximately 4% per annum

- Holding Period for Resale: minimum 5 years

Real Estate Investments in St. Lucia

Saint Lucia offers investors real estate in prestigious areas such as Rodney Bay, with prices ranging from $300,000 to $500,000. These properties can provide a stable rental income.

Additional Expenses:

- Legal Services: $20,000

- Due Diligence: $13,000

- Government Fees: $7,520

- Passport Fee: $520

Investment Return and Conditions Table by Country

For convenience, here is a summary table with the main investment parameters for real estate in the Caribbean:

| Parameter | Saint Kitts and Nevis | Antigua and Barbuda | Grenada | Dominica |

|---|---|---|---|---|

Minimum Investment | $400,000 | $300,000 | $270,000 | $200,000 |

Rental Yield | 4-7% | 2-5% | 3-5% | 5% |

Holding Period | 7 years | 5 years | 5 years | 3 years |

Property Example | Villa for $400,000 | Share in a hotel for $300,000 | Apartment for $350,000 | Villa for $400,000 |

Annual Rental Income | Up to $32,000 | Up to $15,000 | Up to $17,500 | $24,000 |

Main Purchase Expenses | 5-10% of property value | 7-12% of property value | 2-4% of property value | 0.5% of cadastral value |

Advantages | Flexibility in property selection, visa-free access to 150+ countries | Developed infrastructure, various ownership options | Possibility of obtaining an E-2 visa to the USA, exemption from landholding license | Most affordable program, stable property value growth |

Taxes and Fees When Purchasing Property

When you find your dream home, it may seem like all expenses are behind you. However, in reality, the costs associated with purchasing property include not only its price but also a number of additional payments. Before closing the deal, make sure your budget covers all these expenses, or consult a specialist for full information.

So, what additional costs can you expect when purchasing property in the Caribbean?

Stamp Duty

Stamp duty is a tax that is levied when purchasing residential property or land. The rate of stamp duty depends on the value of the property and whether the buyer is a first-time homebuyer.

In the Caribbean, stamp duty rates are as follows:

- Grenada: 1% of the property value.

- Saint Lucia: 2% of the property value.

- Antigua and Barbuda: 2.5% of the property value.

Other Expenses

In Saint Kitts and Nevis, additional expenses are minimal—only 0.2% of the property value. In Dominica, stamp duty is 3.5%. In Grenada, in addition to stamp duty, there is also a 10% tax on the purchase of property valued over $7,500.

Fees for Participation in Citizenship Programs

The fees for participating in citizenship programs vary depending on the country:

- Dominica: $25,000

- Antigua and Barbuda: $30,000

- Saint Kitts and Nevis: $35,000

- Saint Lucia: $50,000

These fees cover the process of applying for citizenship and are mandatory for all applicants.

Investing in the Caribbean real estate can be highly profitable, especially considering the possibility of obtaining second citizenship and all associated privileges. However, as with any other investment sector, it is important to carefully weigh the pros and cons, consider potential risks, and the specific features of each market. By comparing returns and conditions in different countries, you can make an informed decision that ensures not only a stable income but also additional opportunities for international travel and tax optimization.

Migronis offers a full range of services for supporting real estate transactions in the Caribbean, as well as assistance in obtaining second citizenship. Contact us for a professional consultation and learn more about investment opportunities in the Caribbean.